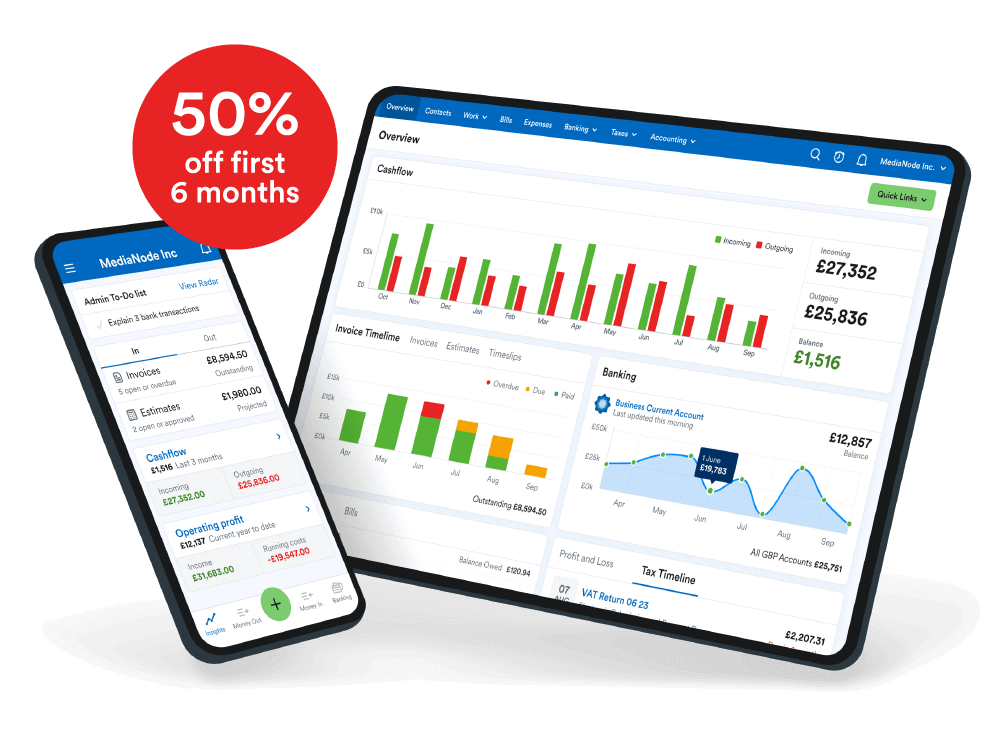

Accounting software for UK-based small businesses

FreeAgent offers easy-to-use online accounting software with a range of features to help small businesses, freelancers, contractors and sole traders stay on top of their business finances.

Accountant or bookkeeper? Find out more